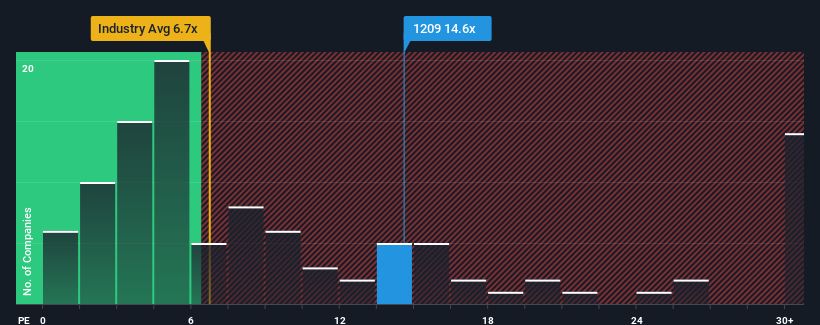

with a price-to-earnings (or “P/E”) ratio of 14.6x China Resources Mixc Lifestyle Services Limited (HKG:1209) may be sending very bearish signals right now, given that almost half of the companies in Hong Kong have a P/E ratio of less than 8x, and even a P/E of less than 5x is not unusual. However, the P/E may be too high for some reason and needs further investigation to determine if it is justified.

Recent times have been good for lifestyle services Mixc China Resources, as its revenue has grown faster than other companies. Many seem to expect strong earnings performance to continue, which has boosted the P/E. Otherwise, existing shareholders may be a bit worried about the sustainability of the stock price.

Check out our latest analysis for Mixc China Resources lifestyle services

If you want to see what the analysts predict for the future, you should check us out Free Report on Lifestyle Services Mixc Resources China.

What do growth metrics tell us about a high P/E?

In order to justify its P/E ratio, China Resources Mixc Lifestyle Services needs to outperform the market tremendously.

If we look at the revenue growth last year, the company recorded a phenomenal 33% increase. In the last three-year period, it has seen an excellent growth of 134% in EPS, which has helped its short-term performance. So, it’s fair to say that recent revenue growth has been phenomenal for the company.

Looking ahead, the next three years are estimated to grow by 13 percent annually, according to analysts who watch the company. This is shaping up to be similar to the 13% annual growth forecast for the broader market.

Considering this, it is strange that the P/E of China Resources Mixc Lifestyle Services is higher than most other companies. Most investors seem to ignore relatively modest growth expectations and are willing to pay for equity exposure. However, additional gains will be difficult to achieve as this level of earnings growth is likely to eventually depress the share price.

The Bottom Line at Chinese Resources Lifestyle Services Mixc’ P/E

It is argued that the price-to-earnings ratio is an inferior measure of value in certain industries, but it can be a powerful indicator of business sentiment.

We’ve established that China Resources Mixc Lifestyle Services currently trades at a higher-than-expected P/E, as its forecast growth is only matched by the broader market. Right now we are uncomfortable with the relatively high share price as projected future earnings are unlikely to support such positive sentiment for long. Until these conditions improve, it is challenging to accept these prices as reasonable.

The company’s balance sheet is another key area for risk analysis. we Free Balance Sheet Analysis for Lifestyle Services Mixc China Resources lets you uncover any risks that could be a problem with six simple checks.

If you are interested in the P/E ratioyou might want to check this out Free A selection of other companies with strong earnings growth and low P/E ratios.

New: Stock screen and artificial intelligence alerts

Our new AI Stock Screen scans the market daily to spot opportunities.

• Dividend powerhouses (3%+ return)

• The value of small purchases of low value with insider shopping

• High growth technology and artificial intelligence companies

Or build your own from over 50 criteria.

Explore now for free

Have feedback on this article? Worried about content? call directly with us Alternatively, email the editorial team (at) simplewallst.com.

This article by Simply Wall St is general in nature. We only provide commentary based on historical data and analyst forecasts using an unbiased methodology, and our articles are not intended as financial advice. This is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. Our goal is to provide focused, long-term analysis based on fundamental data. Note that our analysis may not include the latest price-sensitive company announcements or quality content. Simply Wall St has no positions in the listed stocks.