Nvidia (NVDA)

The artificial intelligence (AI) company is the top trending stock in pre-market deals after analysts said it could be valued at $10 trillion.

Beth Kindig, chief technology analyst at I/O Fund, predicts strong growth and “fireworks” for the stock following the launch of Blackwell’s advanced chip.

Kindig predicted that Nvidia’s growth path will become clearer when Wall Street analysts revise their financial estimates upward for next year. This should be a “big moment” for Nvidia, followed by Blackwell’s 2025 shipping figures.

I say it will be fireworks. The absolute and final fireworks for Blackwell will come in the first quarter along with second quarter guidance, Kindig said. Early next year will be fireworks again for Nvidia, and we’ll be on our way to $10 trillion.

These new chips are nearly twice the size of their predecessors and pack 2.6 times more transistors, which has led to significant manufacturing challenges and impacted profit margins.

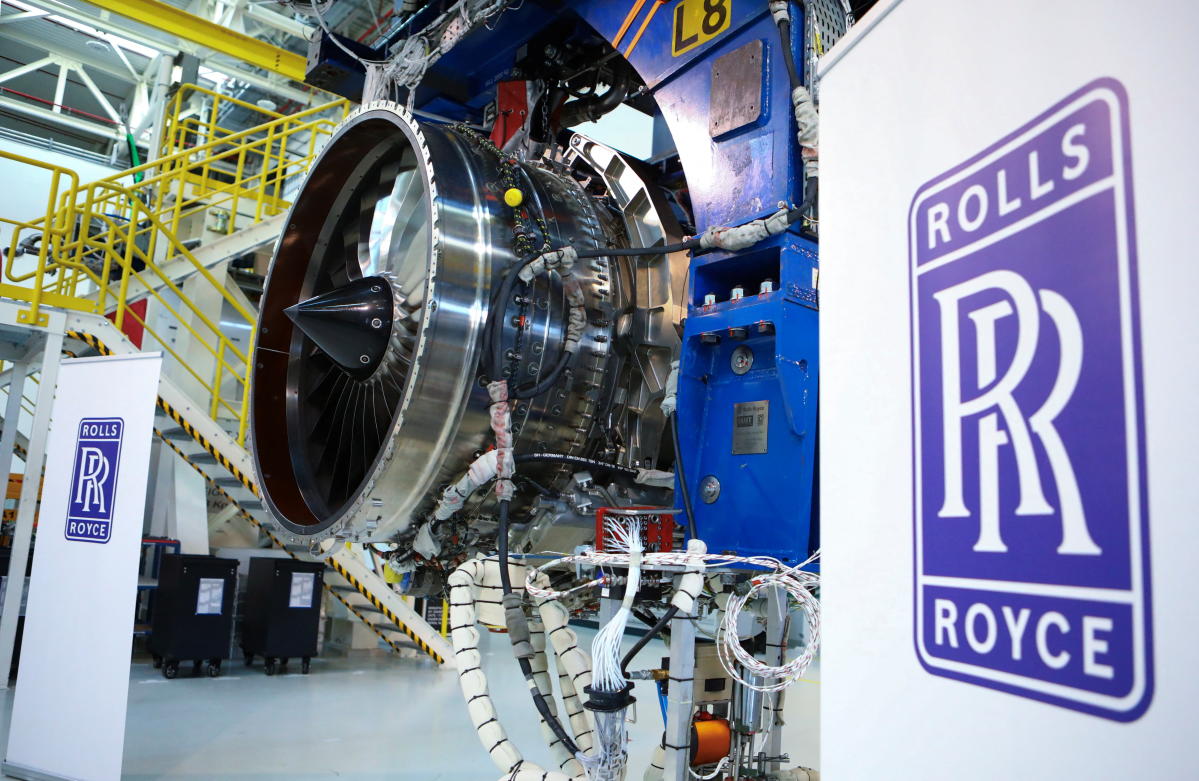

Rolls Royce (RR.L)

Rolls-Royce shares rebounded in early trade after Cathay Pacific said it expected to have its fleet fully operational by the weekend. The Hong Kong-based airline had temporarily grounded its A350s for inspection after discovering problems with the Rolls-Royce engines.

Cathay Pacific (CPCAF) has revealed that 15 components need to be replaced after a “first-of-its-kind” engine component failure forced a Zurich flight to turn back on Monday. In response, the airline canceled at least 34 round-trip flights and began precautionary inspections of its 48-strong fleet.

Read more: The pound outperformed as traders bet on keeping interest rates on hold in September

The airline said three of the 48 Rolls-Royce planes it inspected had undergone successful repairs, and all jets were expected to resume operations by Saturday.

The aerospace engineering company said in a statement that it is aware of the incident that caused Cathay Pacific to ground its Airbus A350 fleet. It added that it was committed to working closely with Cathay Pacific, Airbus ( AIR.PA ) and authorities conducting the investigation.

The news follows a significant fall in the market value of Rolls-Royce, which saw £2.7 billion wiped off by Cathay warning that “a number of aircraft will be out of service for several days”. Shares in Rolls-Royce have since risen 4.3 percent in early trading.

Cathay only plans to keep the grounded aircraft out of service for “a few days,” suggesting that the issue will require a relatively minor and quick fix, and thus won’t call into question the design or engine architecture like we saw on the Trent 1000. . In fact, Ketai has indicated that spare parts have been secured and repair work is underway.

Shares of the electric car maker were slightly lower at the opening bell in the US, despite reporting higher sales in China.

Tesla’s August sales in China jumped 37 percent from July to more than 63,000 vehicles, thanks largely to increases in smaller cities. The delivery of China-made Model 3 and Model Y vehicles has increased by 17% compared to July.

However, its performance is far from its main Chinese competitors. BYD, the world’s largest electric car maker, said its passenger car sales in China rose 35 percent from a year earlier to a monthly record of 370,854 in August. Other local EV rivals, including Leapmotor and Li Auto, also reported higher sales, Reuters reported.

Preliminary data from the China Passenger Car Association estimated that total sales of electric passenger cars in China last month rose 32 percent year-on-year to about 1.05 million units, an 11 percent increase from July.

Shares of Intel were just below flat after rising more than 9 percent in the previous session after Reuters reported that the company plans to propose cost-cutting measures.

The plan, which is expected to be unveiled in mid-September 2024, includes selling businesses such as Altera’s programmable chip unit to reduce overall costs. The proposal does not yet include plans to break up Intel and sell its contract manufacturing or foundry operations to a buyer such as Taiwan Semiconductor Manufacturing (TSM), according to Reuters.

Read more: Inflation in the Eurozone has decreased to 2.2% and is close to the European Central Bank’s target

To help with the strategic review, Intel has hired financial advisors Morgan Stanley and Goldman Sachs.

The move is part of an effort to rejuvenate the chip maker’s financial performance. Intel has faced challenges as it seeks to regain its footing in the artificial intelligence chip market, which is dominated by Nvidia.

After reporting Q2 earnings, its market cap has fallen below $100 billion.

Download the Yahoo Finance app that for Apple and Android.