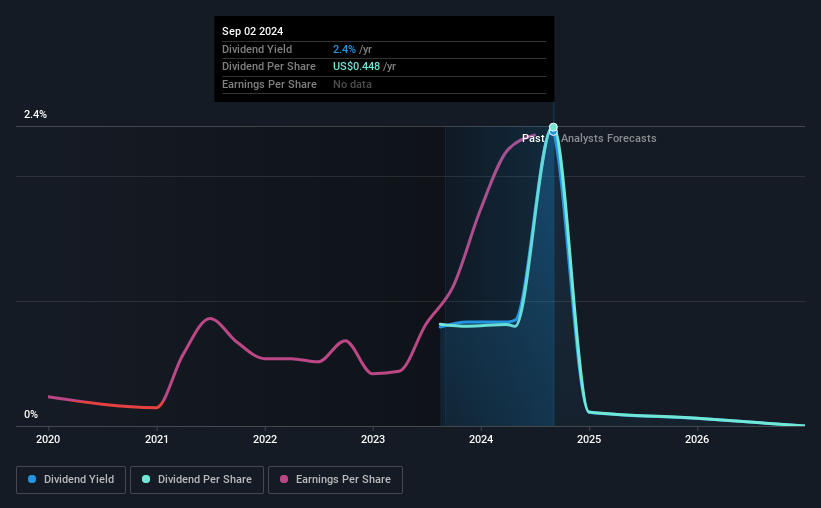

Atur Lifestyle Holdings Limited (NASDAQ:ATAT) has announced that it will increase its dividend to CN¥0.40 from the same payment last year on September 30th. Based on this payout, the dividend yield for the company would be 2.4%, which is fairly typical for the industry.

Check out our latest analysis for Atour Lifestyle Holdings

Lifestyle Author Holdings’ dividend is well covered by earnings

Dividend yields don’t mean much unless the payments are stable. Based on the latest payout, Lifestyle Author Holdings easily had enough revenue to cover the dividend. This shows that a large part of the income is invested in the business.

Earnings per share are expected to increase by 76.4% in the coming year. If the dividend continues on this path, the payout ratio could be 3.0% by next year, which we think could be very sustainable going forward.

Author Lifestyle Holdings does not have a long payment history

It is not possible for us to make a retrospective judgment based only on a short payment history. This doesn’t mean the company can’t pay a good dividend, but we just want to wait until it can prove itself.

Dividends seem likely to grow

Some investors try to buy some shares of a company based on its dividend history. It is encouraging to see that Atour Lifestyle Holdings has grown its earnings per share by 127% per year over the past five years. The company has no problem growing despite its high return to shareholders, which is a great combination to own as a dividend stock.

We really like Author Lifestyle’s dividend

In general, a dividend increase is always good, and we think Atur Lifestyle Holdings is a strong income stock thanks to its track record and growing earnings. Earnings easily cover distributions and the company generates plenty of cash. All in all, this checks many of the boxes we look for when picking income stocks.

Market movements show how much a stable dividend policy is worth compared to one that is more unpredictable. At the same time, there are other factors that our readers should be aware of before investing in stocks. For example, we have identified 2 warning signs for Author Lifestyle Holdings which you should be aware of before investing. Isn’t Holding Lifestyle Author the opportunity you were looking for? Why not check us out Choosing the best dividend stocks

New: Manage all your stock portfolios in one place

We have created The ultimate portfolio companion For stock investors, And it’s free.

• Connect an unlimited number of portfolios and view your total in one currency

• Be alerted by email or mobile phone about warning signs or new dangers

• Track the fair value of your stock

Try the portfolio demo for free

Have feedback on this article? Worried about content? call directly with us Alternatively, email the editorial team (at) simplewallst.com.

This article by Simply Wall St is general in nature. We only provide commentary based on historical data and analyst forecasts using an unbiased methodology, and our articles are not intended as financial advice. This is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. Our goal is to provide focused, long-term analysis based on fundamental data. Note that our analysis may not include the latest price-sensitive company announcements or quality content. Simply Wall St has no positions in the listed stocks.